How to Use eCom to Tally Tool

Step-by-step guide on using the eCom to Tally Tool in GST Tool to simplify eCommerce GST compliance. Learn to import data, generate Tally XML.

1 year ago

Written by GST Tool Team

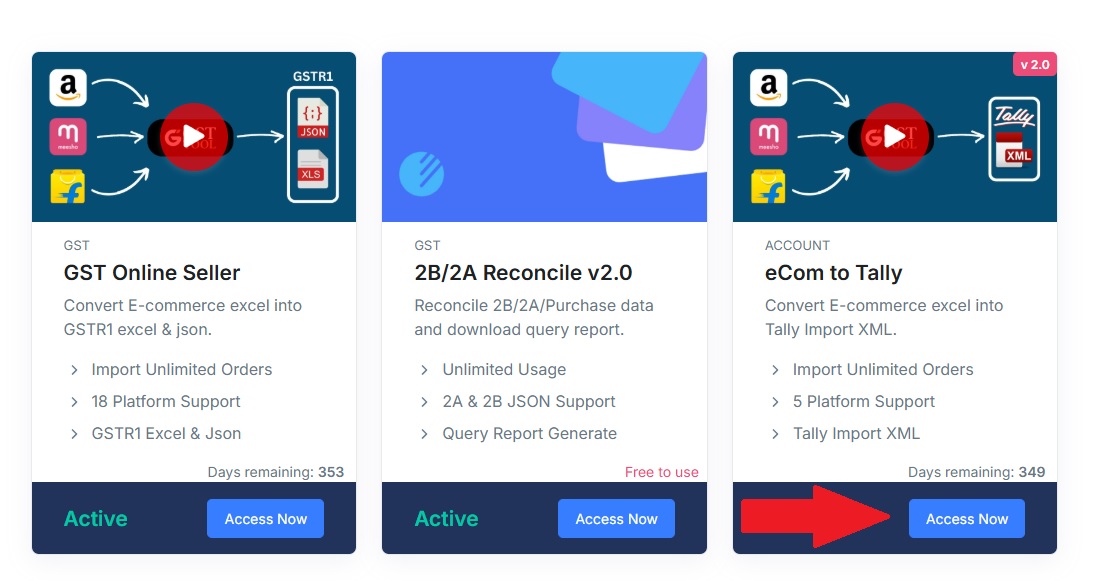

Managing eCommerce transactions and integrating them into Tally can be a time-consuming task. The eCom to Tally Tool in GST Tool simplifies this process, allowing users to seamlessly import and manage their eCommerce data in Tally. Follow the steps below to use this tool efficiently.

Step 1: Log in to the Dashboard

- Log in to your GST Tool account.

- Navigate to the Dashboard.

- Locate the eCom to Tally section and click the Access Now button.

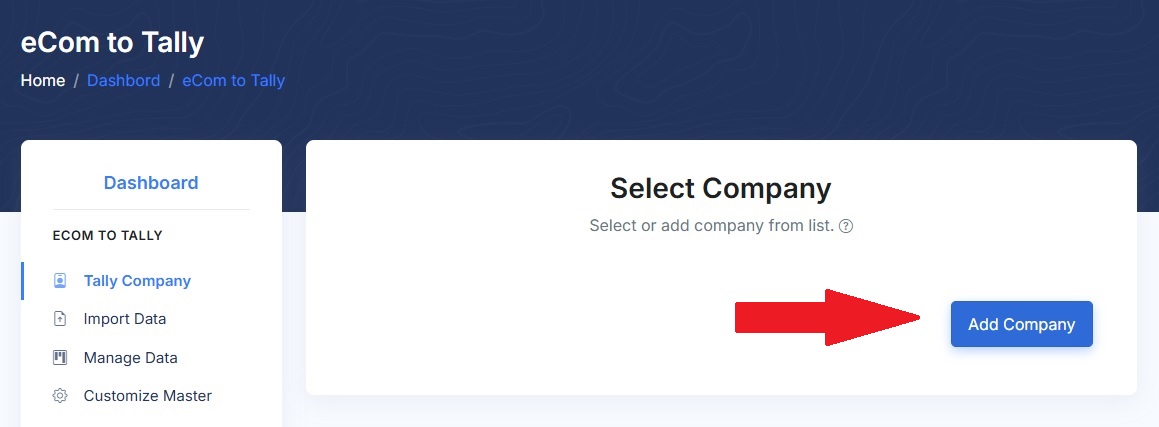

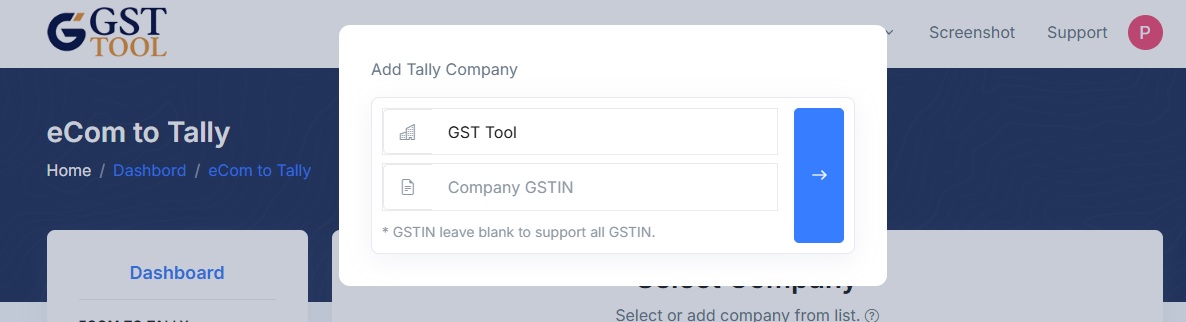

Step 2: Add or Select a Company

If you already have a company added, select it from the list. if not add new company.

- Click the Add Company button.

- Provide the Tally company name and GSTIN. (Leave GSTIN blank to import data for all GSTINs.)

- Click the Import Data button.

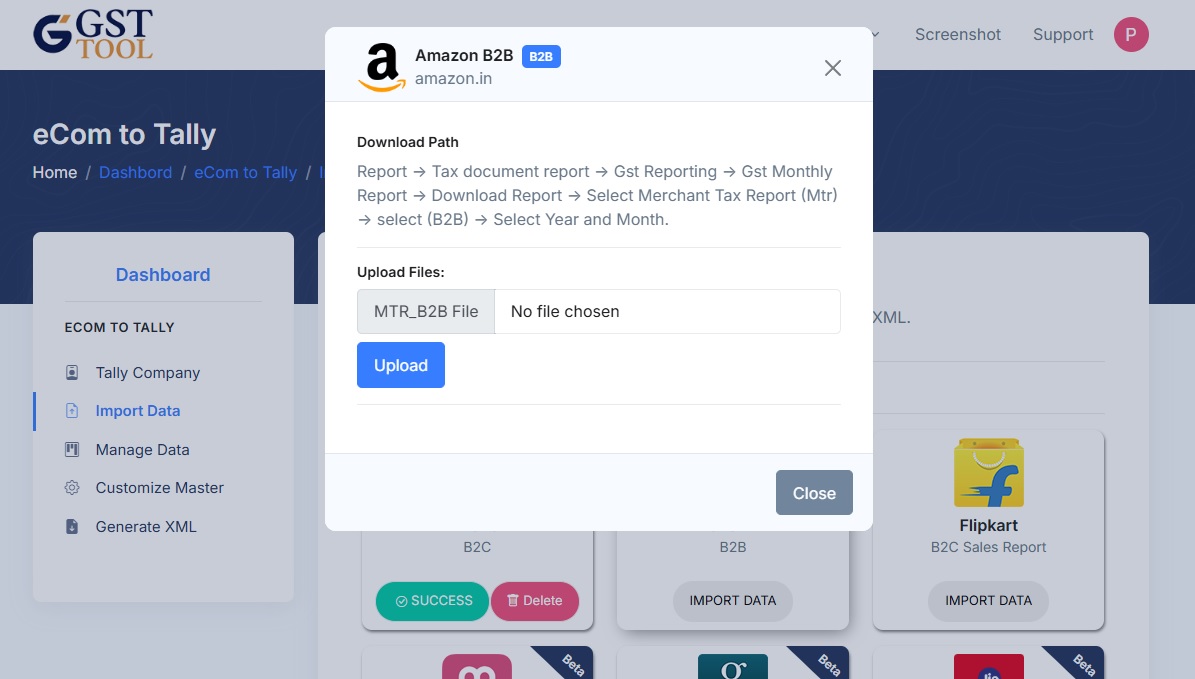

Step 3: Import Data from Your eCommerce Platform

- Select your platform (e.g., Flipkart, Amazon, Meesho, Jio) and click Import Data.

- Follow the steps to download data from your eCommerce platform.

- Return to the eCom to Tally Tool and click Upload Files to upload the downloaded file.

- Check the status to confirm a successful upload.

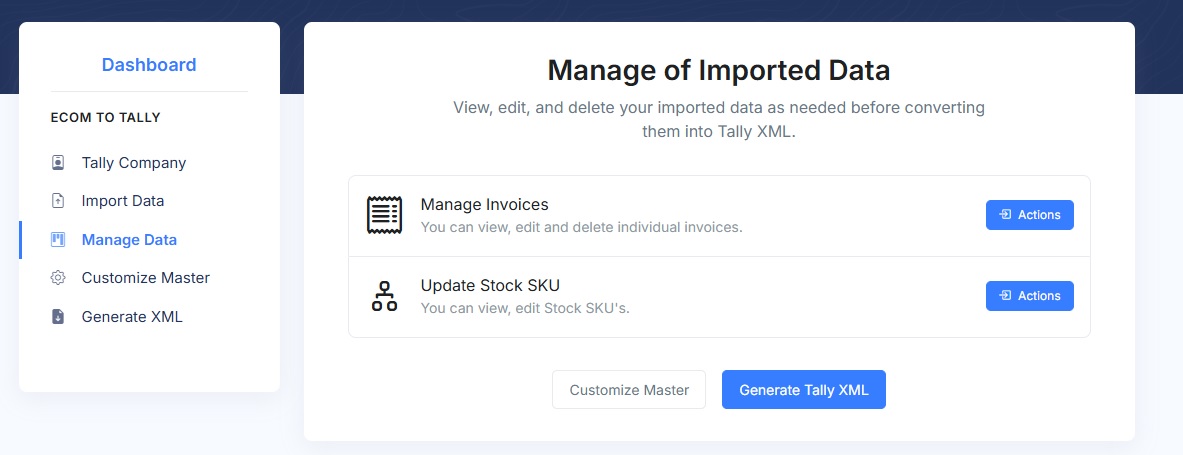

Step 4: Manage Imported Data

View, edit, or delete complete eCommerce platform data or individual invoices. Update your SKU mapping to match your Tally stock items.

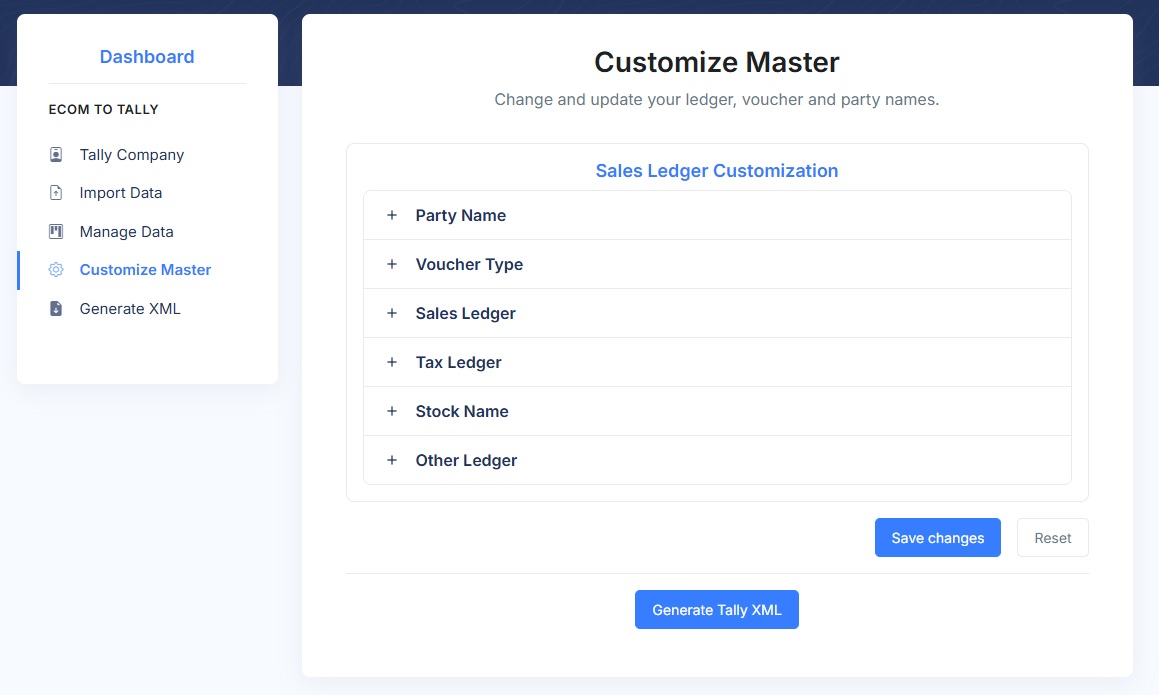

Step 5: Customize Masters

If using the tool for the first time, customize details such as: Party Name, Voucher Name, GST ledger, Ledger Names and much more..

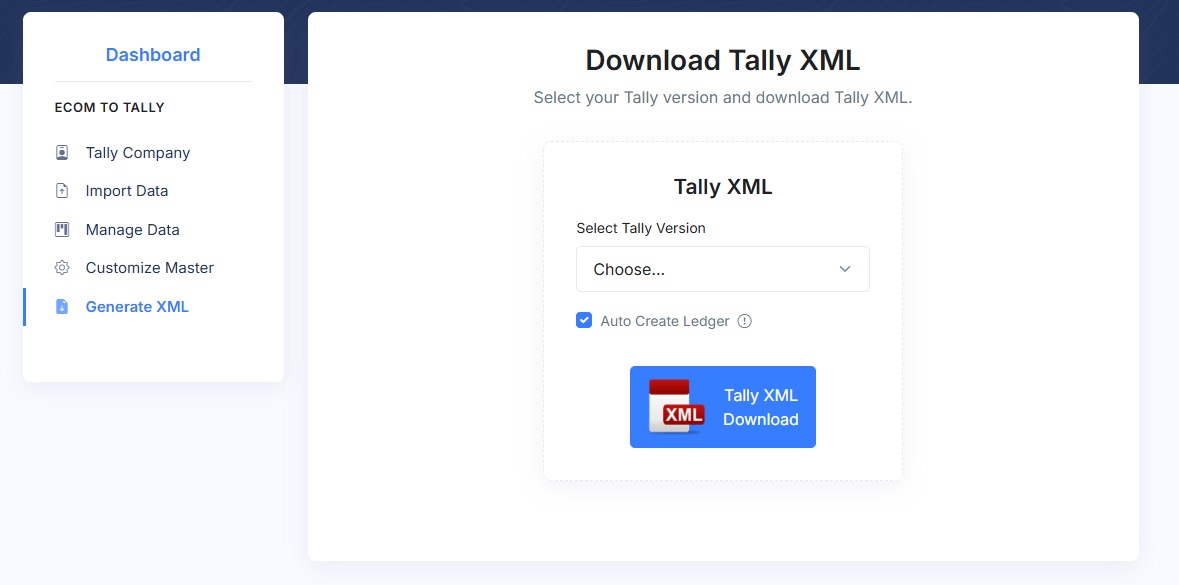

Step 6: Download Tally XML

- Navigate to the Generate XML Page.

- Select your Tally version.

- Tick the Auto Create Ledger checkbox if needed.

- Click Download XML and import it into Tally.

By following these steps, you can efficiently use the eCom to Tally Tool in GST Tool to automate invoice entries in Tally, saving significant time and effort.

Start using the tool today and streamline your eCommerce accounting process!

Was this article helpful?

6 out of 12 found this helpful