Fix Negative Values in Table 14 (GST)

Learn how to fix the GST error "Negative values are not allowed in Table 14."

1 year ago

Written by GST Tool Team

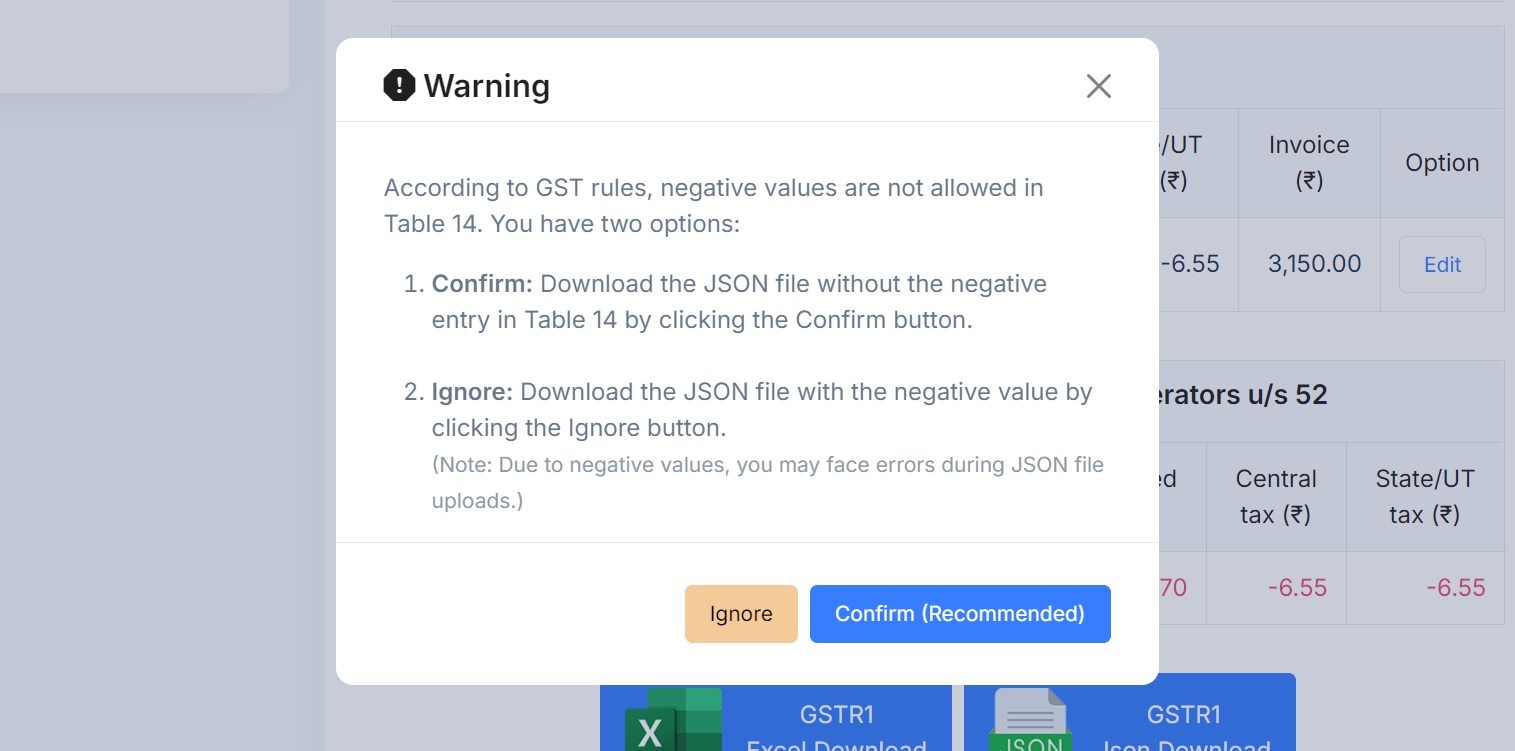

If you're encountering the warning that Negative values are not allowed in Table 14, you have two options to resolve this issue:

Option 1: (Simple)

Confirm:

- Download the JSON file without the negative entry in Table 14 by clicking the Confirm button.

- You can then proceed to upload the JSON file.

Note: This option will convert the negative value to zero from Table 14. Use this option with caution.

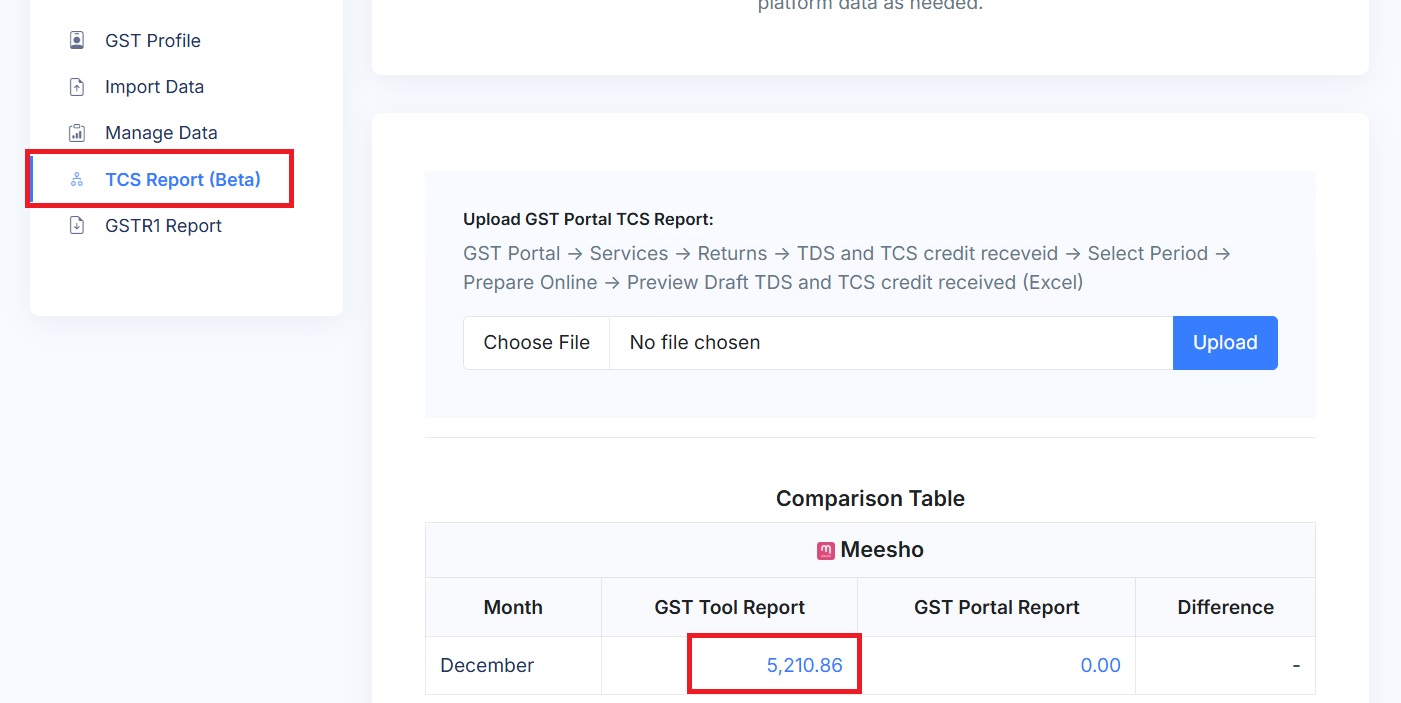

Option 2: Recommended Method (Manual Correction from TCS Report)

This method helps you fix negative values in Table 14 by manually correcting data from the TCS Report.

- Go to the TCS Report page.

- Click on GST Tool Report Amount for the relevant platform and month.

- The system will display state-wise data.

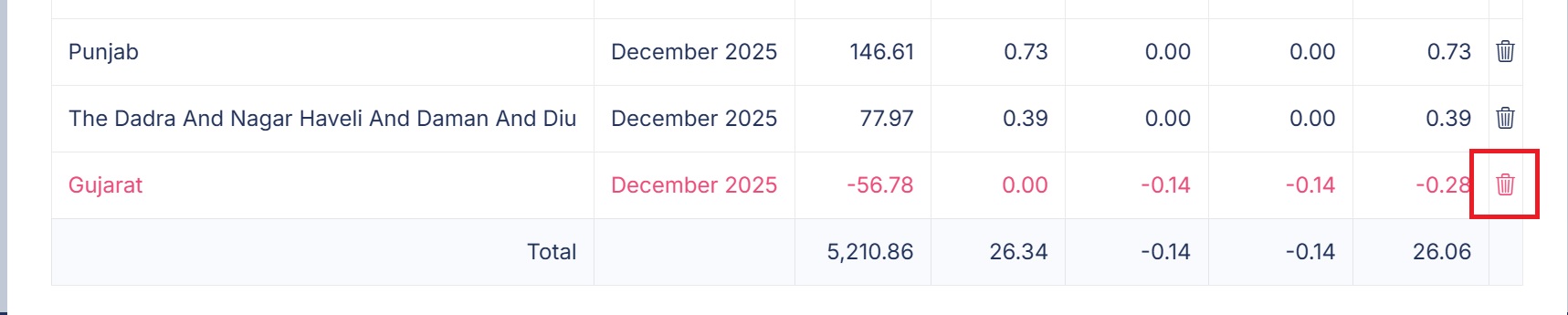

Case 1: Negative value in CGST & SGST

- If CGST and SGST is negative in Table 14.

- CGST and SGST indicate a local (intra-state) sale.

- Find the local state where the value is negative.

- Click the Delete option for that state.

- This will remove the negative entry and fix the issue.

Case 2: Negative value in IGST

- IGST indicates inter-state sales.

- If IGST is negative in Table 14, it usually means that returns are higher than sales in other states.

- In this case, do not delete the local state data.

- Delete the other state (inter-state) data where the negative IGST appears.

Important Note:

- After deleting return data, the sales value may increase.

- This option is recommended only to remove negative values so the GST return can be successfully accepted by the GST portal.

Was this article helpful?

13 out of 21 found this helpful